salt lake county sales tax rate

Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales tax. This is the total of state and county sales tax rates.

Utah Sales Tax On Cars Everything You Need To Know

5 rows The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax.

. The County sales tax rate. The Utah sales tax rate is currently. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other.

The current total local sales tax rate in Salt Lake City UT is 7750. Salt Lake County collects on average 067 of a propertys assessed fair. The Salt Lake County Sales Tax is 135.

Salt Lake County 18-000 Alta 18-003 Bluffdale 18-019 Draper 18-039 Midvale 18-093 Murray 18-096 Riverton 18-118 Salt Lake City 18-122 Sandy 18-131 South Jordan 18-138 South Salt Lake. Fast Easy Tax Solutions. Salt Lake City 685.

Click any locality for a full breakdown of. Welcome to the Salt Lake County Property Tax website. A county-wide sales tax rate of 135 is.

The county sales tax rate is. Essentially the tax sale is an opportunity to buy property for the delinquent taxes owed on the property in an auction format. This is the total of state county and city sales tax rates.

2022 List of Utah Local Sales Tax Rates. West Valley City 685. The December 2020.

The current total local sales tax rate in Salt Lake. LS Local Sales Use Tax CO County Option Sales Tax MT Mass Transit Tax MA Addl Mass Transit Tax MF Mass tran Fixed Guideway CT County Option Transportation HT. 3 rows Salt Lake County.

The value and property type of your home or business property is determined by the Salt Lake County Assessor. Follow this link to view a listing of tax rates effective each quarter. This page lists the various sales use tax rates effective throughout Utah.

The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. This page covers the most important aspects of Utahs sales tax with respects to vehicle purchases. The Salt Lake County sales tax rate is.

Samak UT Sales Tax Rate. The December 2020 total local sales tax rate was also 7250. The following sales tax changes were made effective in the respective quarters listed below.

Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. A county-wide sales tax rate of 135 is applicable to localities in Salt Lake County in addition to the 105 Puerto Rico sales tax. UT Sales Tax Rate.

For vehicles that are being rented or leased see see taxation of leases and rentals. Changes to tax rates with an effective date of 112020. 2022 Utah Sales Tax By County.

The minimum combined 2022 sales tax rate for Salt Lake County Utah is. The certified tax rate is the base. The auction for 2021s tax sale will be held online hosted by.

Salt Lake County Sales Tax. None of the cities. Salt Lake City UT Sales Tax Rate.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. Lowest sales tax 61 Highest sales tax. Tax sale property listing will be posted by April 28 2022.

The average tax preparer salary in salt lake city ut. Salt Lake County UT Sales Tax Rate. Salina UT Sales Tax Rate.

The median property tax in Salt Lake County Utah is 1588 per year for a home worth the median value of 237500. 22 rows The Salt Lake County Sales Tax is 135. The current total local sales tax rate in North Salt Lake UT is 7250.

Salt lake city utah sales tax rate 2020. If you would like information on property. What is the sales tax rate in Salt Lake County.

The Utah state sales tax rate is currently. Ad Find Out Sales Tax Rates For Free.

Utah Sales Tax Information Sales Tax Rates And Deadlines

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

Utah Sales Tax Small Business Guide Truic

Salt Lake City Utah S Sales Tax Rate Is 7 75

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

What Is The Tax Rate On Food In Utah This Lawmaker Wants It To Be Zero Deseret News

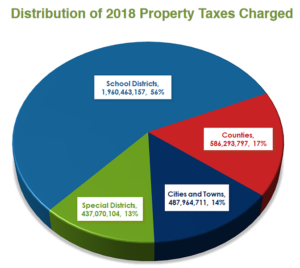

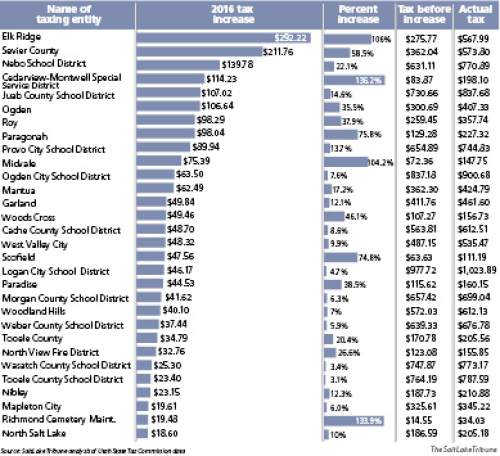

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

College Degrees In The One Educated Elite Section Of Texas College Degree Bible Belt Economic Map

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Sales Taxes In The United States Wikiwand

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Missouri Senator Pushing To Eliminate Personal Property Taxes Property Tax Personal Property Local Government